10 Year Federal Note Canada

Canadian investors are asking how to protect their portfolios from inflation. Anyone who watches television knows the popular answer, which is to purchase gold bullion from one of a variety of companies hawking their lustrous wares by infomercial. To those who want some income from their investment, another alternative is the Canadian government Real Return Bond (RRB) program, which issues inflation-linked government bonds.

Is Canadian Inflation High?

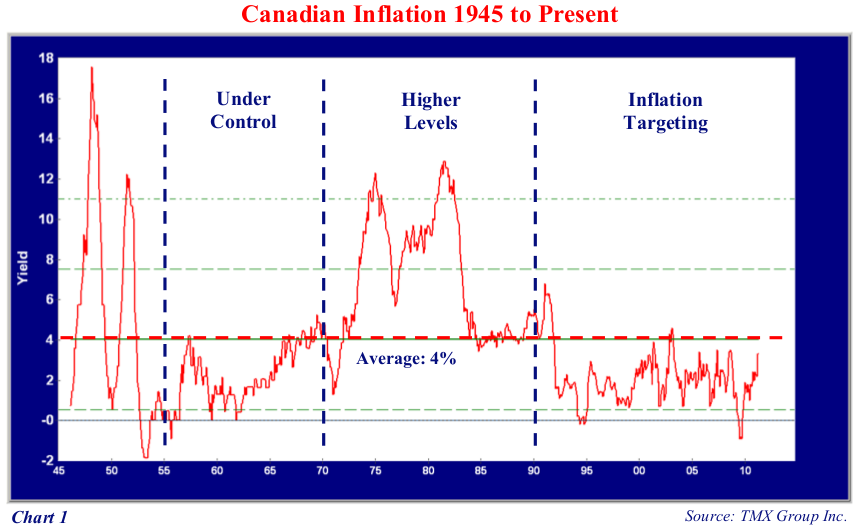

Before we explain how RRBs can protect a portfolio against inflation and the risks of doing so, we need to do a bit of research to see whether it is worth protecting a portfolio from Canadian inflation. A prudent soldier or investor studies his enemy. We need to understand what the Canadian inflation experience has been. Is it high or low from a historical perspective? That really depends on the period. Following the prime directive of our favourite statistics professor, we first must "graph the data". To keep the degree of analysis manageable, we examine the post World War II period, although CPI data is available back to 1914 and GDP deflator data goes back to 1870. The Canadian Consumer Price Index (CPI) has averaged 4% since 1947, as shown in Chart 1 below.

Chart 1 usually proves quite a shock to investment professionals and neophytes alike. They are astounded by the fact that the highest Canadian inflation of nearly 18% occurred in the late 1940s, not the 1980s.

During the Second World War, consumer goods were rationed and wages and prices were controlled by government boards. With little for consumers to spend on, savings were patriotically placed in War Bonds. After the war, inflation skyrocketed as wage and price controls were lifted and returning soldiers spent their savings on consumer goods, homes for their new brides and growing "baby boom" families.

Inflation returned to a very low level in the early 1950s with prudent monetary policy, the shift of wartime production to consumer goods and the return of veterans to productive civilian employment. It actually went negative on a year-over-year basis in 1953 to 1954 which is one of the few periods of significant Canadian price deflation. Inflation then hovered around zero in the mid 1950s before climbing to 4% and dropping back to nearly 0% in the late 1950s.

We now turn to three periods after 1955.

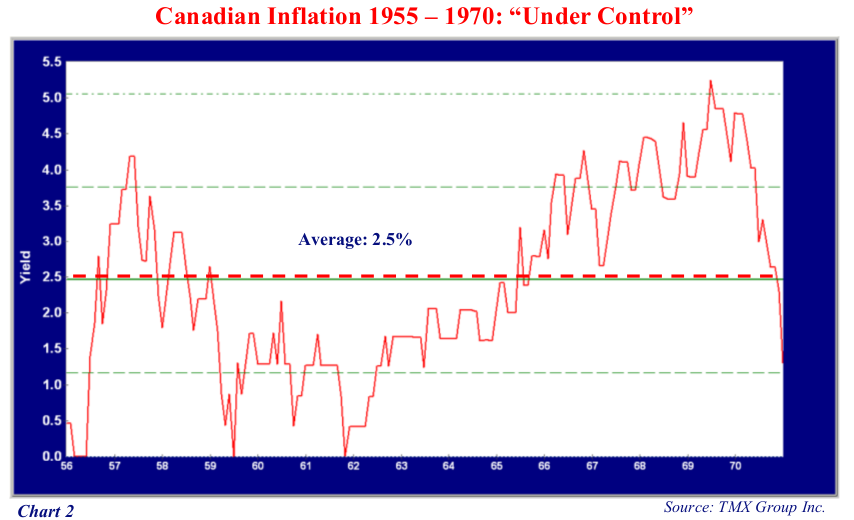

1955 to 1970: Inflation under Control

We call the period from 1955 to 1970 "Under Control". This period is an interesting one, as it was when "Keynesian" economists held sway in both the government and the Bank of Canada. The Canadian dollar floated, but with substantial intervention at times from 1950-62. It was then fixed at US$0.925 in May 1962. Orthodox monetary policy was thrown out in favour of an activist policy which sought to smooth out the swings of the business cycle.

As Chart 2 shows, inflation averaged 2.5% in this period with lows of 0% and highs approaching 5%. We believe this was a period where Canadian monetary policy achieved its dual objective of both subdued inflation and economic growth.

The "Coyne Affair" took place from 1959 to 1961, despite the general belief that monetary policy was an important way to smooth the economic cycle. This transpired when the Diefenbaker government feuded with James Coyne, the Governor of the Bank of Canada, over monetary and economic policy. The Government wanted to pursue expansionist policies but Coyne was an advocate of "sound money" even if unemployment remained high. The Diefenbaker government tried to dismiss him with a successful vote in the House of Commons but failed when the Senate objected. Coyne then resigned voluntarily.

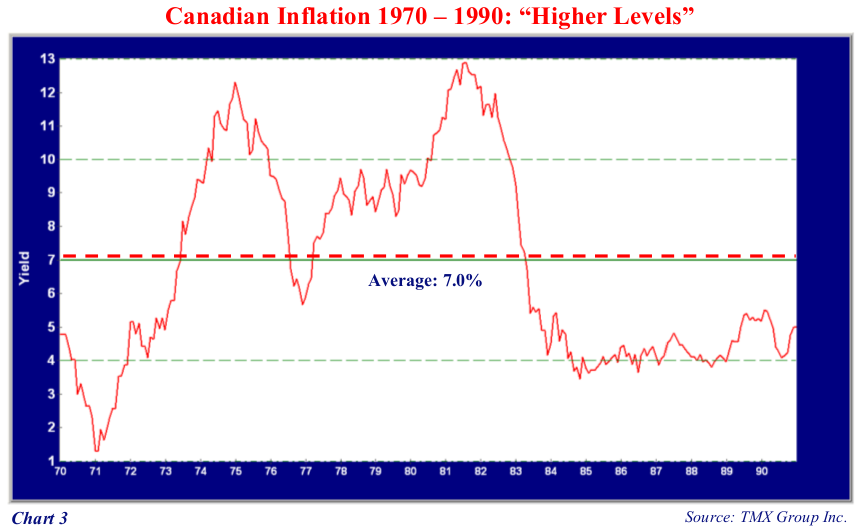

1970 to 1990: Higher Levels of Inflation

Coyne's successors did not keep an emphasis on controlling inflation. Despite the largely successful monetary policy and subdued period of inflation from 1955 to 1970, the seeds were planted for an inflationary spiral in the late 1960s. The United States, seeking to finance the Vietnam War by deficit, suspended the convertibility of the U.S. Dollar into gold in 1971. This effectively ended the post war Bretton Woods international financial system. Not having to back U.S. dollars with gold, the U.S. was free to inflate its money supply without constraint, which it then did. Other central banks followed the money creation fashion of the U.S. Federal Reserve, attempting to strengthen economic growth. Canada abandoned the fixed exchange rate with the United States in 1970, when maintaining the fixed rate became untenable.

This made for very high levels of inflation, as shown in Chart 3 . The Canadian CPI averaged a very high 7% from 1970 to 1990. Canadian inflation rose to 12% in 1975 from 1% in 1971 as central bankers and policy makers sought to counter rising oil prices due to the 1973 Arab oil embargo. The CPI fell to 6% when wage and price controls were introduced by the Trudeau government in 1975. Inflation continued to rise when the controls were lifted, peaking at 12.8% in 1981.

By this point, inflation expectations were firmly embedded in the Canadian economy. It took extremely tight monetary policy by Paul Volcker in the U.S. and John Crow in Canada and a severe recession to lower actual inflation. Lower inflation lowered expectations which resulted in a sharp drop in inflation to the 4% level by 1984. Chart 3 shows that inflation then ranged from 4% to 5% until 1991.

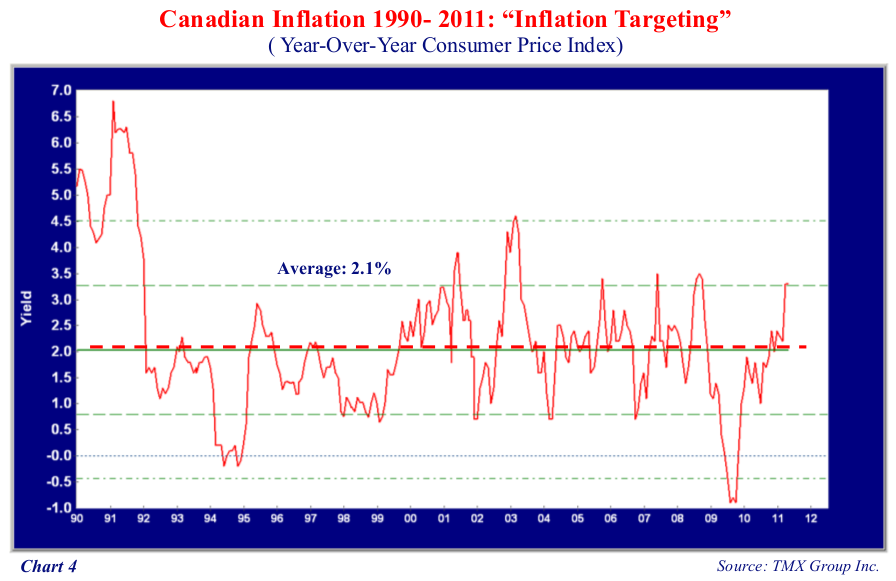

1990 to 2011: Inflation Targeting

The economic vogue to control the economy with activist monetary policy ended badly with the debacle of the inflationary 1970s and 1980s. The monetarist economists held sway with their idea that the only goal of monetary policy should be price stability. The Reserve Bank of New Zealand was the first central bank to enshrine an explicit inflation target.

The Bank of Canada also began to target inflation in 1991 with a 2% target in a band of 1% to 3%. An inspection of Chart 4 shows that the BOC has been very successful in this policy. As Chart 4 below shows, CPI has averaged just above 2% from 1990 to the present. The target was 0% to 2% or "price stability". This was later softened into "below 2%" so the BOC has succeeded in meeting its targets.

How Does One Hedge Against Inflation?

Putting aside the debate over the quality of inflation statistics, one can hedge their inflation exposure, by purchasing inflation-linked bonds such as the Government of Canada Real Return Bond or RRB. This bond is structured like a conventional Canada bond with an important difference; the change in the consumer price index is applied to the principal amount of the bonds.

How Does an RRB Work?

Where a conventional or "nominal" Canada bond pays a coupon based on its interest rate and a par amount of $100, the RRB pays its coupon based on a principal amount that changes with the CPI. For example, the nominal Canada 9.75% of 2021 pays a semiannual coupon of $4.875 (9.75% x 100 / 2) and a principal amount of $100 at maturity in December 2021. The RRB Canada 4.25% of 2021 also matures in December 2021 but its principal has grown with the CPI since its issue in November 1991. Each month, the change in the CPI is applied to inflate the principal amount. The coupon of 4.25% is then applied to the CPI inflated principal.

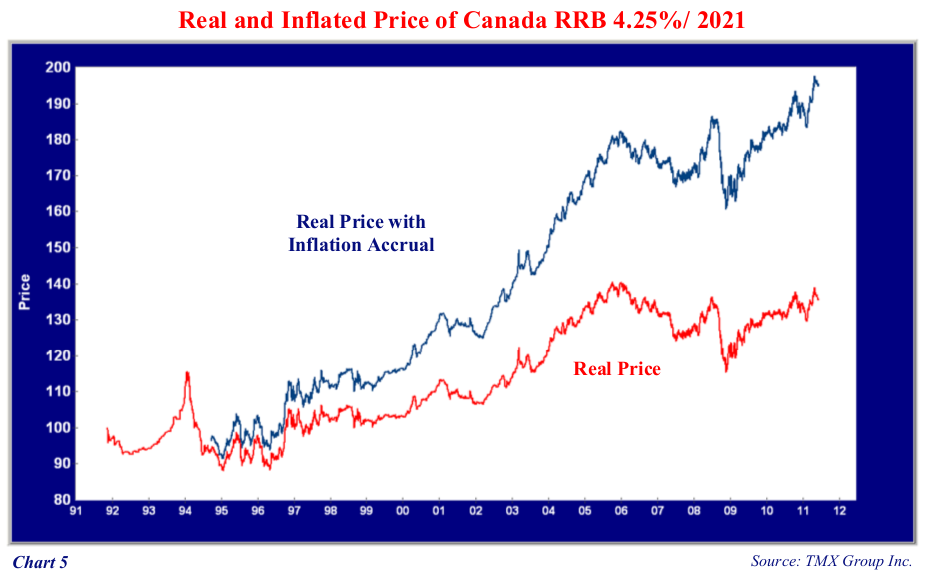

The total amount of the CPI change since issue is called the "inflation accrual" and is calculated by applying the "index ratio" (CPI Index/ Original Issue CPI Index). This can be seen in the following Chart 5 . The red line shows the real price since 1991 and the blue line shows the real price with the inflation accrual applied.

The earliest inflation-linked bonds, the British Inflation-linked Gilts ("linkers" to bond traders), assumed future inflation in their calculations. Other models used the CPI as part of the coupon interest rate, leaving the principal not indexed. The advantage of the RRB structure is that it deals with known quantities without applying unknown future inflation to the calculations. The Canadian RRB model adopted in 1991 has since been copied by most other government inflation-linked bond programs including the Treasury Inflation Protected Securities (TIPS) in the United States.

What is a Real Yield and Price?

The current real price of $135 for the 2021 RRB gives a real yield to maturity of 0.8% based on the 10 years remaining until the Canadian government repays the bond in December 2021. The structure of the RRB is elegant in its simplicity. It takes normal bond mathematics and uses them to establish the "real price" and "real yield". The real price of this bond since 1991 can be seen in Chart 5 . As with any bond, its price has risen as market yields have dropped. The bond is now at a substantial premium reflecting its very high coupon of 4.25% compared to a current new issue RRB at the 1% real yield level.

Real Yields Change With Market Conditions

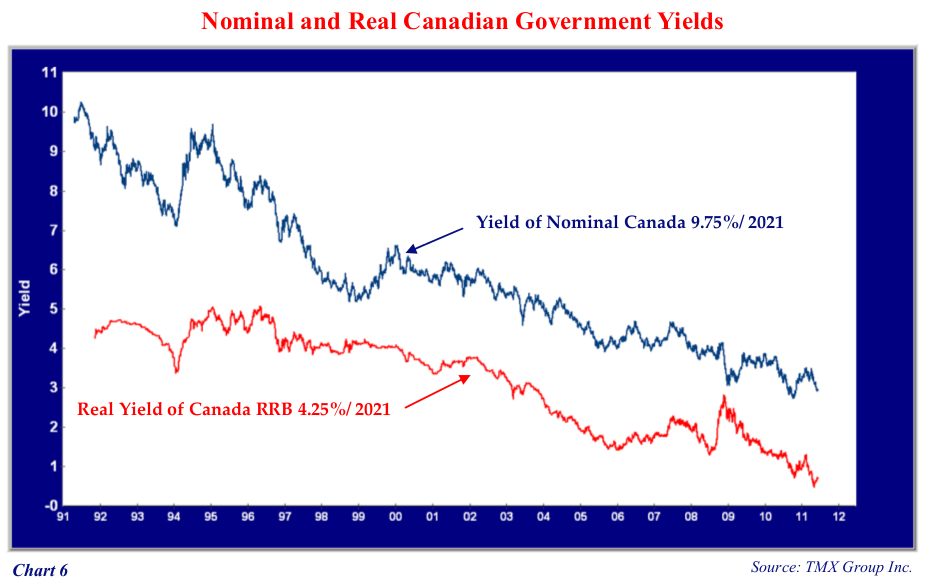

The fall in real yields on Canadian RRBs follows the general fall in interest rates over the past twenty years. The yield on the conventional Canada 9.75% of 2021 is shown as the blue line in the following Chart 6 . It shows that on issue in 1991 that its yield was 9.75% which was the then prevailing level of yields for long-term 30 year Canada issues. Its yield has since dropped to the current 2.75% which is similar to other 10 year Canada bonds. The red line shows the yield of the Canada RRB 4.25% of 2021. This has also fallen considerably. It is important to note that both RRB and conventional nominal bond yields move similarly. They tend to rise and fall together, reflecting underlying bond market and interest rate trends since both conventional Canada bonds and RRBs have a real interest rate component to their yields.

How Do RRB Real Yields Compare to Conventional Canada Yields?

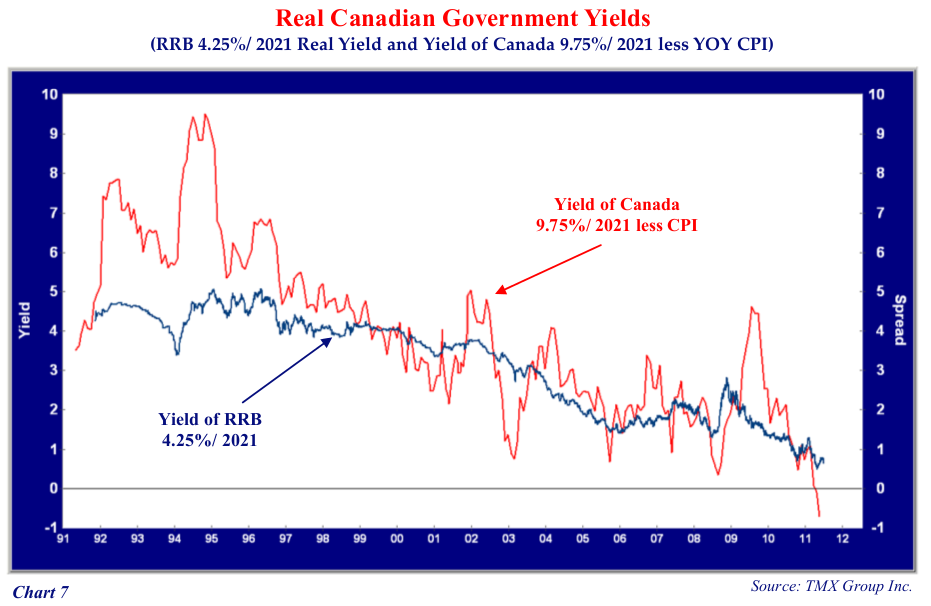

This can be seen in the following Chart 7 which shows the "real yield" on both the Canada 9.75%/ 2021 and the RRB 4.25/ 2021 since both of these bonds were issued in November 1991. The implied real yield of the conventional Canada 9.75% / 2021 is calculated by subtracting the year-over-year CPI from its yield which is shown by the red line. The real yield of the RRB is shown as the blue line. Notably, the real yield of the conventional Canada was much higher from 1991 to 1995 during the period when market sentiment felt that the risk of higher inflation was still substantial. Remember, as shown by the earlier graph of the CPI, the average rate of inflation for the twenty years from 1970 to 1990 had been 7%. As the Bank of Canada's inflation targeting regime gained credibility, nominal yields fell to reflect the new and much lower market inflation estimate.

The real yield premium of nominal Canadas over RRBs fell to much lower levels in the late 1990s. From 2000 until 2002, RRB real yields were higher than the conventional Canada. This was very interesting as it meant that investors received more real yield in RRBs for not accepting the inflation risk of a conventional bond! In this period, investors were convinced "Disinflation", the low and falling inflation rate environment of this period, would continue for a long time and that the inflation protection offered by RRBs was not very valuable. There was also a school of thought that believed a period of deflation, where nominal prices fall, was a risk. This meant that market inflation expectations were very low and negative in some periods.

Since then, RRB yields have tracked the mid point of the conventional Canada real yield. The conventional real yield tends to swing more as inflation changes. The current real yield on the conventional Canada is quite negative at -0.9% since its yield of 2.8% is lower than the current year over year CPI of 3.7%. This reflects the current very loose state of Canadian monetary policy.

"Breakeven Inflation"

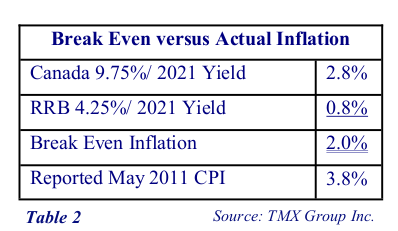

Today an investor can risk his capital for 10 years in the conventional Canada with inflation at 3.3% or choose to hold the Canada RRB at a 0.8% real yield. Which is a better deal? To answer this question we have to consider the concept of "Break Even Spread" or "Break Even Inflation Rate (BEIR)". Break even spread or inflation is the difference between a conventional Canada and the inflation-linked bond of the same term. The current difference between the conventional 9.75%/ 2021 and the RRB 4.25%/ 2021 is 2% (2.75% – 0.8% = 2%). This is called the "break even" spread or inflation since it is the highest inflation that investors estimate, if the market is efficient.

Let's say an investor estimated that inflation would average 4% over the ten years until 2021. If the investor was rational, he or she would calculate their return of holding the conventional Canada at 2.75% by subtracting the inflation estimate of 4% for a -1.25% return over the period. Clearly this investor would buy the RRB with a real yield of .8%. If another investor estimated an inflation rate at 3% his return would be .25% (2.75% -3% = -.25%). If we carry on this estimation, we find that the investor would be neutral between the RRB and a conventional Canada at 2% predicted inflation (2.75% – 2% = .75%) which equates to the 0.8% real rate of the Canada RRB.

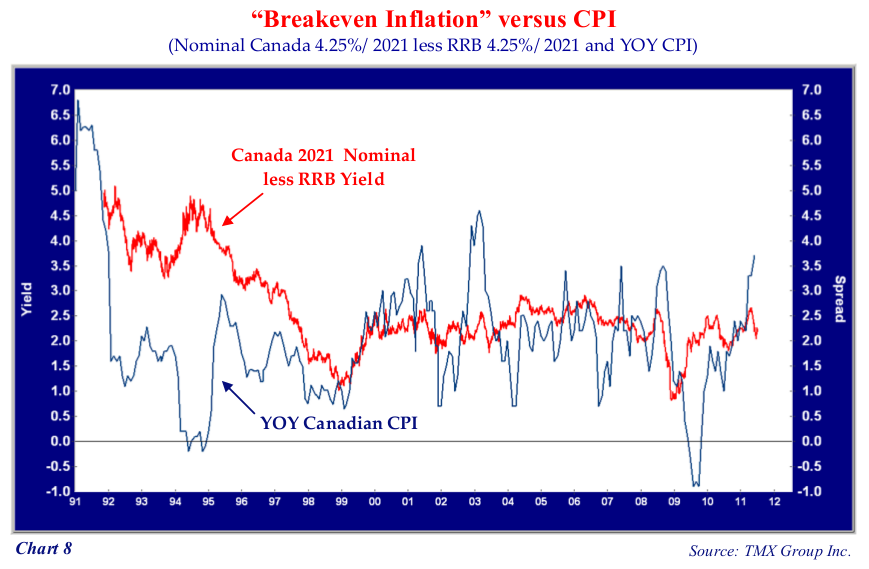

We have graphed the "Breakeven Inflation", the spread or difference between a conventional Canada 9.75%/ 2021 yield and Canada RRB 4.25% yield, in Chart 8 (following page). This represents the Canadian bond market's estimate of what inflation cannot be higher than, if we assume the bond market is efficient.

This graph shows that the bond market and Canadian bond investors considerably overestimated inflation until 1999. They can't really be faulted for this. As we have seen from our graphs of Canadian inflation history, inflation averaged 7% for the twenty years before RRBs were first issued in 1991. Investors didn't trust that the Bank of Canada would actually hit its inflation target of 2% or lower. It took them the 8 years until 1999 to conclude that the BOC would actually make good on its policy. Investors in conventional Canada bonds demanded too high a nominal yield to compensate them for their too high inflation estimate. Since 1999, the breakeven inflation estimate has averaged 2.2%, reflecting the confidence of investors in the BOC inflation targeting regime.

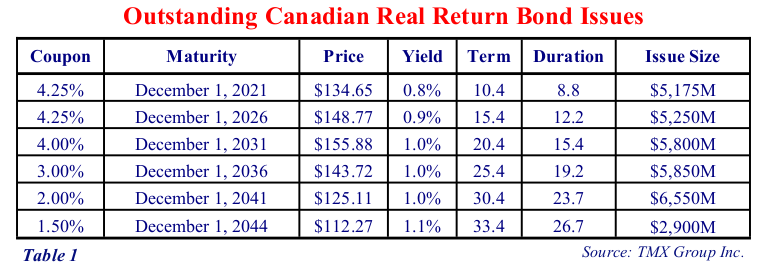

What Do RRBs Yield? Well, we've examined our enemy, Canadian inflation. We've looked at the Government of Canada Real Return Bond, the only way to generate inflation hedged income without having a government pension. What level of income can we generate with complete inflation protection? The RRB Canada 4.24%/ 2021 is the shortest Canadian inflation-linked issue with a term of 10 years. It currently has a real yield of 0.8%. There are other Canadian inflation-linked RRB issues ranging from the 4.25%/ 2026 to the 1.5%/ 2044. We show their yields in Table 1 below.

Looking at our table, we can achieve a "real yield" of just over 1% by investing in RRBs. This means if we invested $1 million dollars in RRBs we would have $10,000 in income that is completely protected from inflation. This does not seem like a lot of compensation for lending our money for a very long period to the federal government. It is not.

It's not really that RRB's are such a bad deal; it reflects the present very low level of real interest rates. In the aftermath of the credit crisis, central banks around the world have provided large amounts of money to the financial markets to rescue the global banking system from their credit stupidity. The current 90 Day T-Bill yield is 1% and inflation is running at 3.7% year over year. This puts the real yield of a 90 Day T-Bill at -2.7%! That means a holder of a T-Bill currently expects to lose 2.7% in real terms of their investment in the next year to inflation. Explained in purchasing power terms, an investor could buy $100 worth of goods and services today but chooses to invest his money to be able to buy $97.30 worth of goods and services a year from now. Why would a rational investor do this?

Printing Money to Keep Interest Rates Low

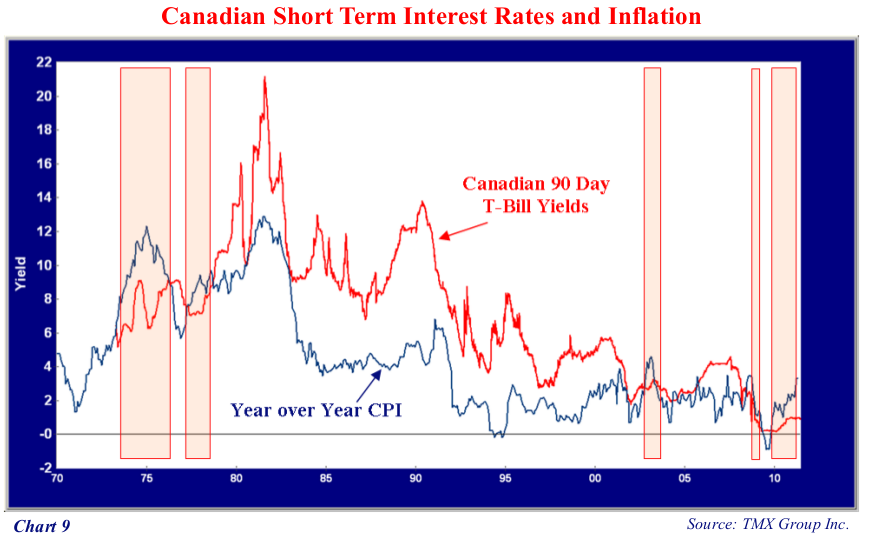

The answer is really that he has no choice. If he wishes to invest his money in a risk free short term investment he is a "price taker". The Governor of the Bank of Canada, Mark Carney, controls short term interest rates through monetary policy and intervening in the money markets. He essentially prints money to buy treasury bills to bid up their price and keep interest rates low. Chart 9 below really tells this tale of banking woe and central bank money printing enthusiasm. It shows Canadian 90 day T-Bills and the year-over-year CPI since 1973. We have displayed the periods when the Canadian CPI was higher than the 90 Day T-Bill yields in orange shading. This shows how unusual it is for short term interest rates to be less than inflation. It also shows clearly how risky the current BOC negative interest rate policy truly is. The only other protracted period of negative real interest rates occurred in the 1970s and caused an inflation problem that lasted for the next 20 years.

In 1973, central bankers were faced with the Arab Oil embargo after the Yom Kippur War. Oil prices shot up and the oil dependent western economies slowed. The central bankers loosened monetary policy to absorb the shock of very much higher oil prices. This can be seen in the Chart 9 where T-Bill yields went negative as inflation soared and loose monetary policy kept administered interest rates low. Loosening monetary policy to absorb the oil shock was probably a good idea. The problem is that more money is a popular thing with voters and politicians. The central banks then failed to sop up the excess money creation. With monetary policy loose and interest rates low, rising inflation took the real yield on T-Bills from -1.8% in May 1973 to -5.5% in 1975.

Once inflation got out of control, the Trudeau Liberal government instituted wage and price controls in one of the greatest political turnarounds in Canadian history. Wage and price controls had been proposed by the Progressive Conservative Party during the 1974 election but were opposed by the Liberals. This helped the Liberals win the election. The Trudeau government then controversially implemented them from 1975 to 1978:

"Canada's only experience in peacetime with controls occurred 1975-78 in response to the exceptionally high inflation rates of 1974-75. The federal Anti-Inflation Act established a 3-year controls system. Wage guidelines were binding on all firms with 500 or more employees, on all federal employees, and (with the agreement of the majority of provincial governments) on most other public-sector employees. Profit-margin controls restricted the price and cost markups of large firms. Although the magnitude of the effect of the legislation is debatable, empirical analysis has generally supported the claim that the controls program did reduce inflation below the level that otherwise would have prevailed." Ronald G. Wirick, Wage and Price Controls, The Canadian Encyclopedia, www.canadianencyclopedia.com

Real Yields Are Extremely Low

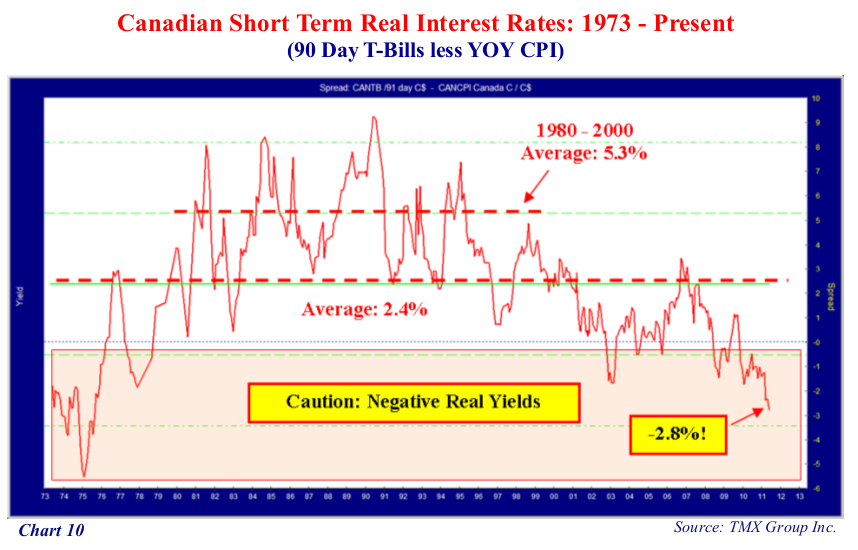

We have plotted the administered short term real interest rate from 1973 to present below. Wage and price controls and tightening monetary policy took the T-Bill real yield back to positive territory in 1976 but by then inflation expectations were then firmly embedded in the Canadian economy. Once the politically unpopular wage and price controls were ended in 1978, inflation once again soared to very high levels.

Paul Volcker, Chairman of the U.S. Federal Reserve, tightened monetary policy aggressively in the United States. John Crow, Governor of the Bank of Canada, moved aggressively as well. The Canadian TBill yield peaked at 21.2% and inflation peaked at 12.9% in July 1981. In the one year period from July 1980 to July 1981, the real yield of T-Bills soared from 0.2% to 8%.

Short term interest rates that were much higher than inflation slowed the economy considerably. Volcker and Crow proved their point that inflation is a monetary phenomenon. Inflation dropped consid- erably and stayed well below its peak levels for the rest of the 1980s. Notably, real yields on T-Bills stayed very high from 1980 to 1990, averaging 5.3%.

Chart 10 really points out the danger of negative real interest rates. Short term interest rates have been negative since the end of 2008, except for a brief period in 2009 when the falling CPI put them slightly positive. The current -2.8% has not been experienced since the inflationary 1970s. The inflation danger is acute but central bankers have every reason to procrastinate, just as their predecessors did in the early 1970s.

What Will Happen to RRB Real Yields?

We know that real interest rates are very low. The question is what does this mean for inflation-linked bonds. Well, the inflation protection of RRBs is highly desirable, despite the questions about the understatement of statistical inflation. Now that we have inflation-linked bonds, we can look at their behaviour since 1991 to assess what will happen to their yields.

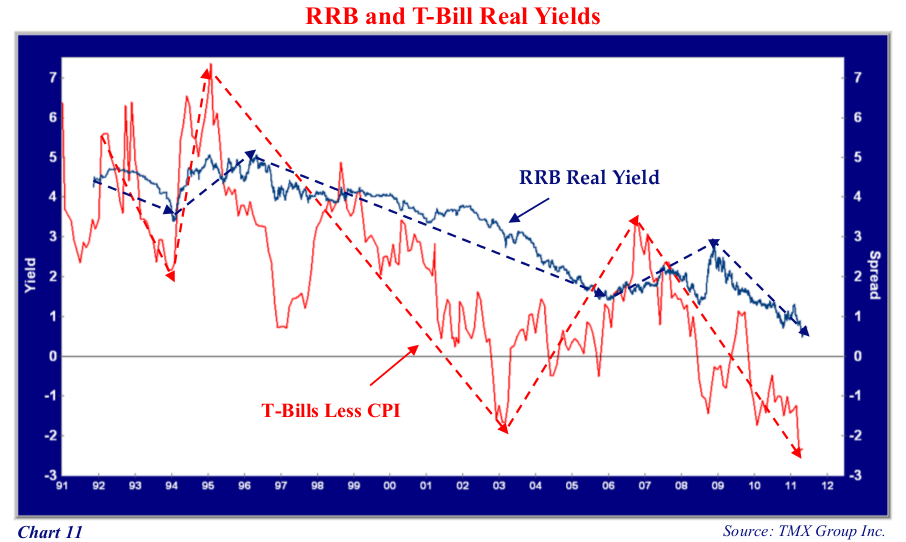

We have plotted the real yield (yield less YOY CPI) of 90 Day Government of Canada Treasury Bills and the RRB 4.25%/ 2021 real yield since 1991. The real yield on T-Bills has been very volatile. This reflects the current vogue of activist monetary policy. Chart 11 shows the Bank of Canada is not immune from "over controlling" as it tries to jump start and then brake the Canadian economy.

The BOC kept real yields on T-Bills at higher levels in the early 1990s and then dropped them to 1% in 1997. This period of excessive monetary ease ended very badly when real yields were raised in 1999 with the dot.com speculative bust of the stock market in 2000. The BOC then pushed real yields down with a low of -1.5% in 2003. Once again this excessive monetary accommodation ended very badly when real yields were raised in 2007. The result was the 2008 credit crunch which has now led to real yields being the unprecedented -2.3%!

Why is the Bank of Canada Keeping Real Yields So Low?

Why does the Bank of Canada push interest rates up and down and destabilize the financial markets? The temptation to kick start the economy is irresistible to the Governor of the BOC since politicians and the voters who elect them want a strong economy and are vehemently vocal about it. Would you want to be the BOC Governor that "destroyed the recovery" and caused high unemployment? The result is that the BOC and other "modern" central banks like the U.S. Federal Reserve relax monetary policy for far too long during periods of economic weakness. Perversely, they eventually end up having to tighten monetary policy much more aggressively when inflation starts to rise and they are criticized for being "weak on inflation".

But what does this walk down inflation mem- ory lane and critique of monetary policy mean for RRBs you ask? The real yield of RRBs moves with real interest rates as shown in Chart 11. We have also plotted the real yield on the Canada RRB 4.25%/ 2021 as the blue line on Chart 11 to compare it to the real yield of 90 Day T-Bills. Note that when this first RRB issue appeared in November 1991 at a yield of 4.25%, the real yield of T-Bills was in the vicinity of 5%. When the real yield on T-Bills fell to 2.5% in 1994 the real yield of RRBs fell to 3.5%.

RRB real yields tend to track the real yields of Canada bonds of similar terms as we have shown earlier. We have shown the general moves up and down in the real yield of T-Bills as a proxy for the state of monetary policy. When T-Bill real yields are low this indicates very loose monetary policy. As we would expect, RRB real yields tend to fall in these periods and rise when monetary policy is tight.

Mr. Carney Isn't Concerned About Low Real Rates

The current level of T-Bill real interest rates is unprecedented and reflects the trepidation with which the BOC and policy markers view the aftermath of the credit crisis. They know Canadian consumers have record debt levels and are struggling even with the current extraordinarily low interest rates. They are loath to raise interest rates and slow the economic and financial recovery from the credit crisis. Mr. Carney is literally expropriating income from savers and giving it to borrowers to keep them afloat. Canadians aren't stupid and see that they should accumulate debt at a very low price (very negative real borrowing cost) instead of savings at a very low return (very negative real interest rates).

Once again, we come back to the question of what will happen to inflation and real return bonds. At some point, Mr. Carney will have to raise interest rates if he does not want to return to the high inflation of the 1970s and 1980s. His predecessors at the BOC decided to err on the side of economic growth in this period and inflation became entrenched as a result. In our view, Mr. Carney will not tighten monetary policy until it is obvious that inflation is persistently well above the BOC target zone of under 2%.

At present, he is not concerned since nobody seems particularly concerned. Consumer and corporate borrowers love the low rate of interest they pay on their debts. Politicians are on the side of lower interest rates as they deficit spend and accumulate the national debt at ever higher levels. Savers are not storming the BOC building to protest his expropriation of a reasonable level of financial income. The real interest rate on T-Bills of -2.3% means that whoever is unlucky enough to hold them for a full year loses purchasing power of the same amount but they're not complaining so who cares.

Real Yields Have to Rise Sometime

As we've said earlier, this very loose monetary policy cannot last forever unless Mr. Carney wants to go down in history as the Governor who restored high inflation to its 1970s and 1980s glory. So what will happen when he finally and grudgingly tightens? Well, historically a real interest rate of 2-3% has been a "neutral level" and a fair real return to in- vestors. With current inflation of 3.3% we would be talking about 5% to 6% nominal rates which would be a 4% to 5% increase from the current level. Clearly, Canadian borrowers are completely unprepared for this level of rates so we expect to have the first tightening moves take T-Bills to somewhere over 2%. As always, this is likely to be inadequate to slow inflation and future interest rate increases will have to be aggressive.

The prospects for a tightening of monetary policy are interesting for Real Return Bonds. As we've seen earlier, the real yields of RRBs move similarly with the real yields of conventional Canada bonds. If the real yield on nominal Canada bonds falls, as it has recently, the real yield on RRBs falls. To examine this issue more closely, we need to consider the concept of real interest rates. This postulates that rational investors seek a real yield or return on their investments. The real yield is comprised of the compensation that an investor requires for the risk assumed in lending his money, the investor's estimate of prospective inflation and some compensation for the risk of being wrong.

As we've said earlier, the difference between the same term RRB and conventional Canada represents the break even inflation rate that inflation cannot be higher than if the market is efficient. It is important to note that the investor might actually have a lower inflation estimate. The additional amount of break even inflation above the investor's inflation estimate represents the additional yield premium demanded for the risk the investor's inflation estimate might be wrong.

Currently, as Table 2 shows, investors expect the opposite. The break even inflation between the RRB 4.25%/ 2021 and the Canada 9.75% is 2.0% over the next 10 years until December, 2021. This compares to the actual May 2011 CPI of 3.8% so obviously investors believe that inflation is temporarily elevated and will fall back on average over the period to the BOC target of 2%. Thinking about it, if investors expected inflation to actually be 3.8%, they could accept a negative yield of -1% (2.8% conventional Canada yield minus 3.8% CPI) on the RRB. This has happened in the United States with TIPS. As opposed to Canada, the U.S. has issued a variety of terms of TIPS. As U.S. T-Bills are effectively at zero yields, the very short TIPS are trading at negative yields. The U.S. TIPS 1.25%/ 2014 is currently trading at a real price of $106 which indicates a real yield of -1.0%. With the CPI in the U.S. currently running at 3.6% (May 2011), this means an investor would expect a 2.6% return (-1% real yield to maturity and 3.6% inflation increase in the principal amount) until maturity in 2014 if inflation stays at this level.

Price Danger Lurks in RRBs

Inflation linked bonds provide an investor with complete protection from official inflation but there are dangers as well. We've seen that RRBs tend to move with the real yields of conventional Canada bonds. We've also seen that the real yields on both Canada bond and T-Bills are extraordinarily low as result of the aggressively loose BOC monetary policy. The duration or sensitivity to real yield changes of RRBs is very high which means that their prices rise or fall significantly with yield changes.

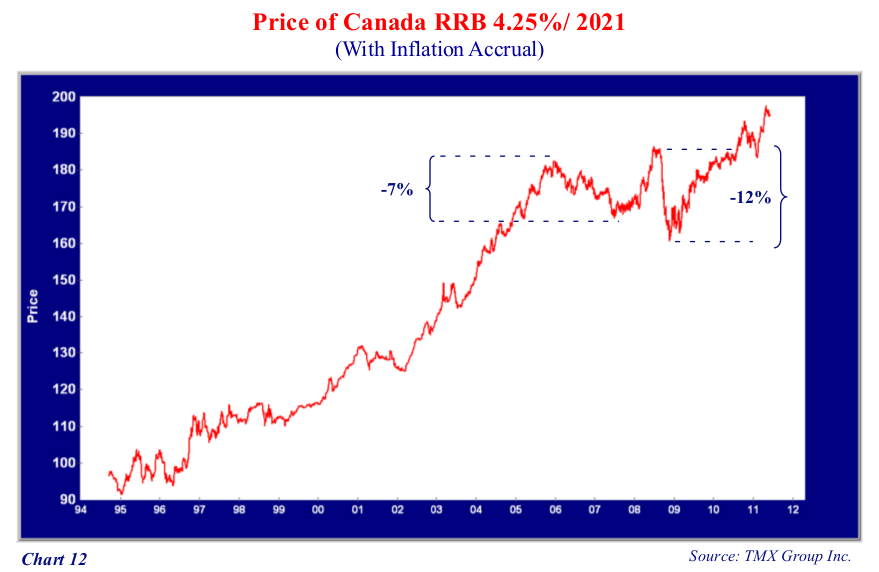

In the following Chart 12 , we have highlighted two periods where real yields rose and RRB prices fell. Chart 12 shows the market price of the 4.25%/ 2012 RRB, including inflation. From 2004 to 2006, the price of the RRB fell 7%, even though inflation was rising in this period. During the credit crisis, from mid 2008 to yearend, the RRB fell 12% as investors feared deflation making the prospective real yield rise on conventional Canada bonds (falling inflation = rising real yield).

The 2008 experience is instructive. Although the RRB offered inflation protection, investors decided to buy conventional bonds that would do better in deflationary conditions and the RRB real yield rose. This resulted in a fall in value of 12%, even given the rise in the principal value through inflation accretion. We believe that real yields are set to rise considerably from the current ultra low levels. Looking at Chart 11 showing RRB and T-Bill real yields, we can see that it wouldn't take too much to get the RRB real yield up to 2%. This would mean a fall of nearly 10% in the real price of the RRB. Inflation would have to rise to 10% for the RRB holder not to have a capital loss.

RRB Price Scenarios

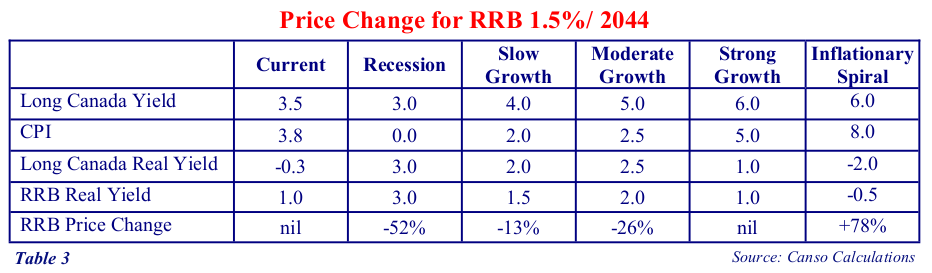

The losses would be even greater with the longer term RRBs which are very sensitive to changes in their real yield. The Canada RRB 1.5%/ 2044 changes 26% in price for each 1% change in its real yield. Let's say the conventional long Canada bonds move from their current 3.5% to 5.0%. In Table 3 below we have laid out some probable scenarios for the RRB 1.5%/ 2044:

This shows the long Canada yield which is currently 3.5%, an estimate of the CPI for the scenario, and the real yield (Long Canada Yield less CPI). We have then estimated the real yield for the RRB 1.25%/ 2044 and the real price change this would imply. The important point of this table is that the real yield on an RRB is influenced by the implied real yield of a similar term Canada. A current long Canada at 3.5% with the CPI at 3.8% has a real yield of -0.3%. This is very low, reflecting very loose monetary policy. We explain these scenarios and the implications for RRB real yields and prices as follows:

Recession : The long Canada real yield could rise in a number of ways. If the long Canada yield falls but inflation falls more, the real rate would increase. This is the scenario we have laid out. We would expect if a severe recession is encountered, bond yields will fall and inflation would fall even more. In this situation, the real yield would rise on both nominal Canadas and RRBs. RRBs, given their very long duration, would fall 52% if real yields rose 2%.

Slow Growth : We would expect the long Canada yield to rise to 4%, reflecting a normalization of monetary policy. CPI would be subdued and match the BOC target of 2.0%, falling from its current higher levels. If RRB yields rose 0.5% to 1.5%, reflecting the 2% long Canada real yield, it would be a fall of -13% in the RRB real price.

Moderate Growth : A moderate growth scenario would see long Canada yields rise as investors discount recession and disinflation. A long Canada yield of 5% and CPI of 2.5% would mean a real yield of 2.5%. If the RRB real yield rose 1% to 2.0% this would indicate a drop of -26% in the real price of the RRB.

Strong Growth : We have long Canada bonds rising to 6% in a strong growth scenario with inflation rising to 5%. This would raise the real yield to 1% but we would think RRB real yields would stay at 1%. This would leave the RRB real price unchanged.

Inflationary Spiral : A BOC struggling to catch up would mean inflation above bond yields, as in the 1970s. We have used a 6% long Canada yield with a higher CPI at 8%. This would be a very good scenario for RRBs with real yields on the long Canada at -2%. A negative RRB yield at -.5% would mean a substantial real price appreciation of 54%.

Are RRBs Good Value?

A rising real yield is very dangerous for RRBs. The Canadian government has only issued long-term RRBs since the program began in 1991. The shortest term and least price sensitive RRB is the original 4.25%/ 2021 which was originally issued as a 30 year and now only has 10 years until maturity. This would move 8% in price for every 1% change in real yield. A portfolio modeled on the DEX RRB index would move 16% for each 1% change in real yield. As we've shown in our scenarios, the RRB 1.5%/ 2044 would move 26% for each 1% change in real yield.

Since real yields are very low at present, they are likely to rise if monetary policy is tightened. From the discussion of the scenarios above, it is likely the RRB real yields would rise which would result in quite severe price drops. Rising inflation with falling real yields on long Canada bonds is the best outcome as reflected in the Strong Growth and Inflationary Spiral scenarios.

As we have said, we expect that the BOC and Governor Carney will eventually and very grudgingly tighten. The bond market will react well before him which could see conventional Canada yields rise despite loose monetary policy.

Conventional bond yields are very low reflecting the BOC ultra low interest rates policy. This means RRB yields are very low. Investors seeking inflation protection have bid up the price of RRBs. We think this makes RRBs "priced for perfection", since the market consensus is quite worried about rising inflation. Perversely, rising inflation and rising conventional Canada yields could result in a considerable downside for RRBs.

On the other hand, RRBs as a "tail risk" inflation hedge makes some sense. Our thought is to keep the real duration of an RRB portfolio as short as possible. Since the original RRB 4.25%/ 2021 has the shortest duration with not much yield give up, they are where we think the real value is in the RRB issues available.

Source: https://www.cansofunds.com/canadian-inflation-and-the-prospects-for-real-return-bonds/